Hello,

The 4th Incentive cycle on Theta Mainnet started on Mar 7, 2022, and ended on Apr 6, 2022.

As the 4th cycle comes to an end, we will review the performance of the incentivized pairs and determine the reallocation of volt for the 5th cycle from Apr 7, 2022 to May 6, 2022.

We have a different ongoing forum discussion to adopt a new approach for Volt allocation to liquidity pools here;

We will focus on the new approach with the next cycle.

A few Important aspects to be reiterated;

- Due to the exploit of Meter Passport, the WETH and BNB assets are unbacked on Meter Mainnet and Theta Mainnet. The existing pools will be discontinued to ensure all existing liquidity is removed and the assets are out of circulation

- To ensure that the users continue to earn rewards on their capital, we propose a daily allocation to the VOLT single staking pools until the pools can be restarted

- Meter Mainnet VOLT single staking pool allocation – 2000 Volt daily

- Theta Mainnet VOLT single staking pool allocation – 500 Volt daily

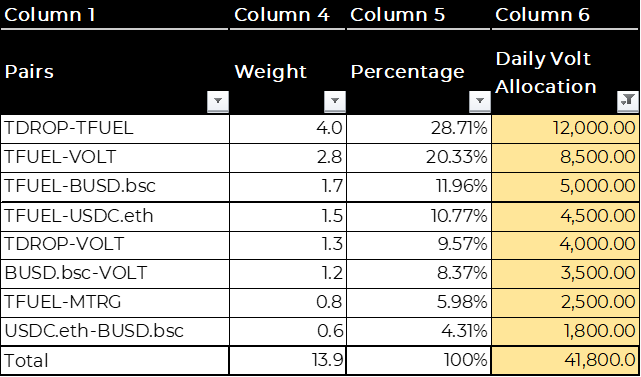

TL, DR:

Evaluation Criteria of Incentivized Liquidity Pairs:

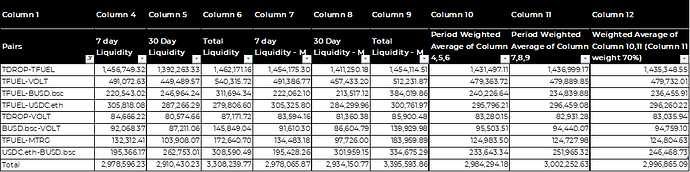

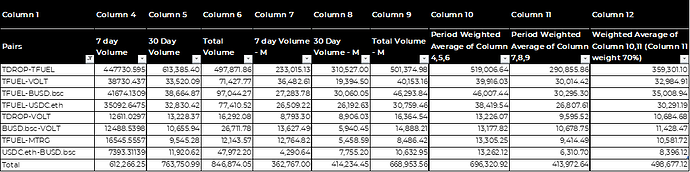

We could define a few of the critical parameters that will help us evaluate the performance of the liquidity pairs on Voltswap;

- Transaction Volume

- This is by far the most important parameter for evaluation since the goal of the product is to generate free cash flows from the operations and be self-sustainable

- Total Value Locked (TVL)

- This is a critical parameter to gauge the adoption of the DEX. Higher TVL is typically correlated with higher adoption and enables bigger buys on the DEX without too high a price impact

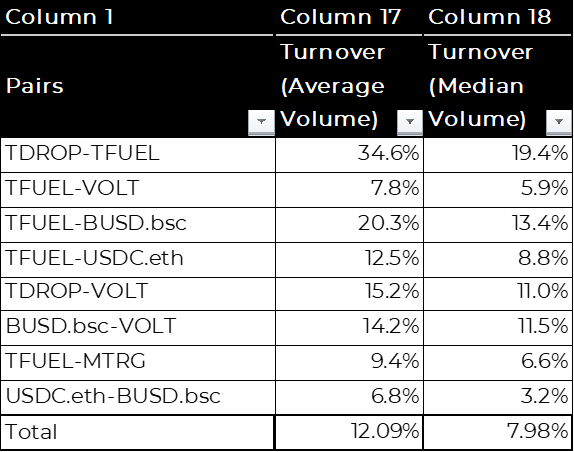

- Turnover of the pair

- It can be defined as the ratio of Volume by TVL

- Higher volume for a specific TVL means that the pair has a higher utilization of assets and the LPs are generating higher revenues due to the turnover.

- Historical Impermanent Loss

- The APY would address the IL loss incurred by the users through higher VOLT allocation

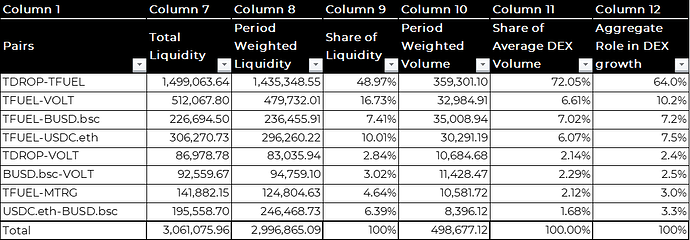

| Pair | Period Weighted Liquidity | Period Weighted Volume | Goal |

|---|---|---|---|

| TDROP-TFUEL | 1435348.55 | 359301.1 | 1. Pool with highest transaction volume 2. Maintain higher allocation to incentivize additional liquidity 3. Current LPs have low IL loss, Higher APY (volt allocation + LP fees) generating higher passive income for LPs |

| TFUEL-VOLT | 479732.01 | 32984.91 | 1. Higher allocation to maintain high liquidity for volt token 2. Reduce impact of IL loss for current LPs |

| TFUEL-BUSD.bsc | 236455.91 | 35008.94 | 1. Continue allocation to support liquidity and transaction volume 2. Current LPs have low IL loss, Higher APY (volt allocation + LP fees) generating higher passive income for LPs |

| TFUEL-USDC.eth | 296260.22 | 30291.19 | 1. Continue allocation to support liquidity and transaction volume 2. Current LPs have low IL loss, Higher APY (volt allocation + LP fees) generating higher passive income for LPs |

| TDROP-VOLT | 83035.94 | 10684.68 | 1. Higher allocation relative to the liquidity to maintain high liquidity for volt token 2. Current LPs have low IL loss, Higher APY (volt allocation + LP fees) generating higher passive income for LPs |

| BUSD.bsc-VOLT | 94759.1 | 11428.47 | 1. Higher allocation relative to the liquidity to maintain high liquidity for volt token 2. Current LPs have low IL loss, Higher APY (volt allocation + LP fees) generating higher passive income for LPs |

| TFUEL-MTRG | 124804.63 | 10581.72 | 1. Higher allocation to reduce impact of IL loss for current LPs |

| USDC.eth-BUSD.bsc | 246468.73 | 8396.12 | 1. Maintain APY as current LP seems adequate to meet overall liquidity 2. Increase APY as liquidity on key ecosystem tokens increases |