Hello Meterians,

The first Incentive cycle on Theta Mainnet started on December 7, 2021. It will end on January 6, 2022.

As the first cycle comes to an end, we will review the performance of the incentivized pairs and determine the reallocation of volt for the second cycle from January 7, 2022 to February 6, 2022.

This review will also take inputs from the earlier analysis conducted mid-way. The earlier analysis can be found here:

Evaluation of Incentivized Liquidity Pairs:

We could define a few of the critical parameters that will help us evaluate the performance of the liquidity pairs on Voltswap;

- Transaction Volume

- This is by far the most important parameter for evaluation since the goal of the product is to generate free cash flows from the operations and be self-sustainable

- Total Value Locked (TVL)

- This is a critical parameter to gauge the adoption of the DEX. Higher TVL is typically correlated with higher adoption and enables bigger buys on the DEX without too high a price impact

- Turnover of the pair

- It can be defined as the ratio of Volume by TVL

- Higher volume for a specific TVL means that the pair has a higher utilization of assets and the LPs are generating higher revenues due to the turnover.

- Number of Txs and average transaction value

- The average transaction value helps us estimate whether the liquidity available in the pool is enough to ensure the users have lower slippages

- This information is currently now available on Theta Mainnet deployment

Evaluation Parameters:

- The overall role of a pair is a factor of both the TVL it adds to the Voltswap as well as the transaction volume of the pair.

- However, the intent of TVL is to primarily aid transactions and lower slippages, we will try to weigh transaction volume at 65% and TVL at 35% to gauge an overall role of a pair in the growth of the ecosystem

- We will also try to look at the turnover (average 1-day Median Volume by TVL) to determine the capital efficiency of the pairs

Based on the above parameter, lets us look at the statistics on Theta Mainnet

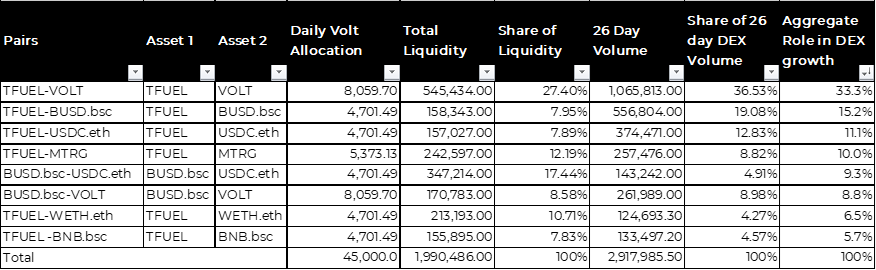

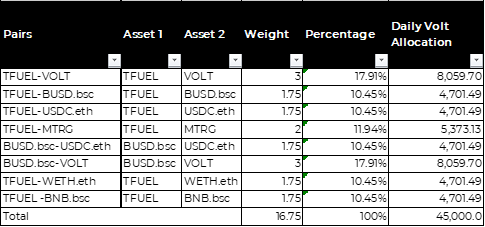

1. Current Volt allocation to the Incentivized Pairs

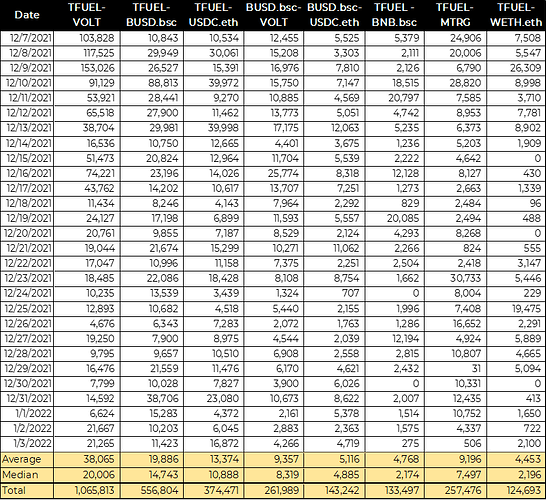

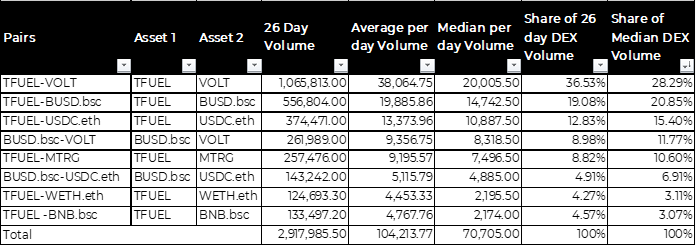

2. Daily transaction volume of Incentivized Pairs

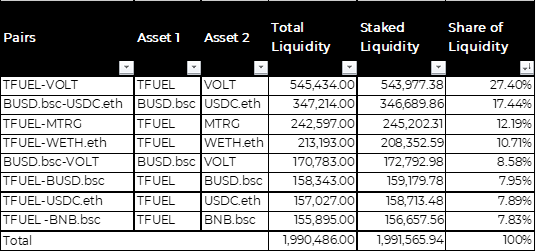

3. Liquidity for Incentivized Pairs

4. Transaction Volumes for Incentivized Pairs

5. Evaluation of Pairs based on overall role in DEX Growth (65% weight to transaction volume and 35% weight to TVL)

Insights

- TFUEL-VOLT pair is by far the best performing pair in terms of Liquidity as well as Transaction Volume.

- BUSD.bsc-USDC.eth, TFUEL-WETH.eth, and TFUEL-BNB.bsc have a small share of the overall volume at ~4% each

- BUSD.bsc-VOLT liquidity is hovering around 150K to 200K range throughout the cycle even as it had the highest daily volt allocation

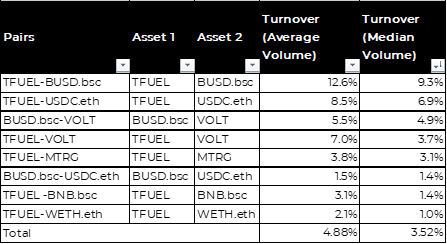

6. Turnover (Volume by TVL) for Incentivized Pairs

The turnover data presents another perspective on the insights presented earlier.

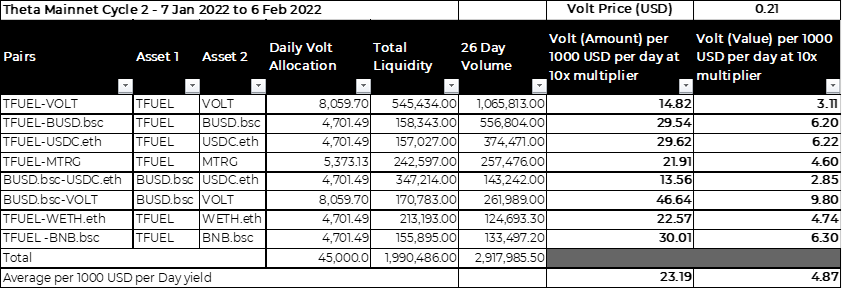

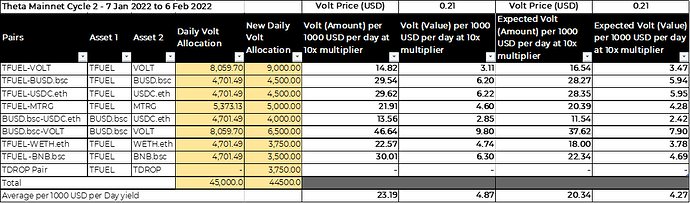

7. Volt Earnings per 1000 USD of Liquidity provided

Insights

- BUSD.bsc-VOLT, TFUEL-BUSD.bsc, and TFUEL-USDC.eth provide the most earning potential per $1000 USD of liquidity provided through a combination of transaction fees and Volt rewards

- TFUEL-VOLT, BUSD.bsc-VOLT, and TFUEL-MTRG has experienced the most impermanent losses due to the relative price between pair assets

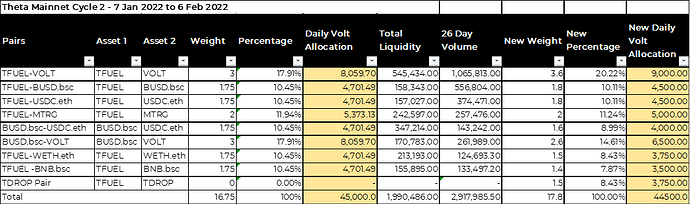

Based on above insights, the volt allocation proposed for the 2nd cycle on Theta Mainnet are as below;

The Volt Earnings per 1000 USD of Liquidity provided based on new Volt allocation is as below;

Insights:

- Assessing that BUSD.bsc-VOLT has not received traction in the first cycle, the volt emission is reduced. Even so, the pair still remains the highest Volt earnings per 1000 USD of liquidity provided. We anticipate users to provide more liquidity and deepen the pool further

- BUSD.bsc-USDC.eth has the lowest volt earnings. This is due to 2 reasons – Lower transaction volumes and no impermanent loss

- TFUEL-WETH.eth and TFUEL-BNB.bsc allocations are reduced due to much lower transaction volumes. The volt earnings are still equivalent to average earnings.

- 3750 Volt allocation is reserved for the TDROP pair and will be allocated upon its launch on Theta Network.

- The estimated earnings are at Volt price of $0.21 USD and Voltswap valuation of $1.9 million USD. The earning potential significantly increases with increased Volt price.

Higher liquidity provision for Volt pools is the key reinforcement driver that will enable increased volt price as well as lower price impacts for users.