Hello,

The 7th Incentive cycle on Theta Mainnet started on June 7, 2022, and ended on July 7, 2022.

As the 7th cycle comes to an end, we will review the performance of the incentivized pairs and determine the reallocation of volt for the 8th cycle from July 8, 2022 to August 7, 2022.

TL, DR:

Evaluation Criteria of Incentivized Liquidity Pairs:

We could define a few of the critical parameters that will help us evaluate the performance of the liquidity pairs on Voltswap;

- Transaction Volume

a. This is by far the most important parameter for evaluation since the goal of the product is to generate free cash flows from the operations and be self-sustainable - Total Value Locked (TVL)

a. This is a critical parameter to gauge the adoption of the DEX. Higher TVL is typically correlated with higher adoption and enables bigger buys on the DEX without too high a price impact - Turnover of the pair

a. It can be defined as the ratio of Volume by TVL

b. Higher volume for a specific TVL means that the pair has a higher utilization of assets and the LPs are generating higher revenues due to the turnover. - Historical Impermanent Loss

a. The APY would address the IL loss incurred by the users through higher VOLT allocation

| Pair | Period Weighted Liquidity (Cycle 6) | Period Weighted Liquidity (Cycle 7) | Period Weighted Volume (Cycle 6) | Period Weighted Volume (Cycle 7) | Goal | Action |

|---|---|---|---|---|---|---|

| TDROP-TFUEL | 578,257.73 | 461,645.32 | 214,391.66 | 151,973.31 | Ensure liquidity as a key pair driving liquidity and volume | Maintain Allocation |

| TFUEL-VOLT | 176,042.64 | 148,139.98 | 16,244.67 | 8,822.98 | Ensure higher VOLT liquidity | Maintain Allocation |

| TFUEL-BUSD.bsc | 95,656.46 | 53,304.65 | 63,121.58 | 12,292.44 | Maintain APY to maintain liquidity | Maintain Allocation |

| TFUEL-USDC.eth | 86,161.22 | 70,345.46 | 24,171.76 | 8,969.09 | Maintain APY to maintain liquidity | Maintain Allocation |

| TDROP-VOLT | 36,104.26 | 27,124.21 | 6,530.04 | 3,615.66 | Ensure higher VOLT liquidity | Maintain Allocation |

| BUSD.bsc-VOLT | 36,205.42 | 25,292.59 | 6,445.09 | 2,101.52 | Ensure higher VOLT liquidity | Maintain Allocation |

| TFUEL-MTRG | 62,061.02 | 58,048.79 | 3,246.16 | 3,241.75 | Maintain APY to maintain liquidity | Maintain Allocation |

| USDC.eth-BUSD.bsc | 148,001.82 | 128,015.68 | 16,818.92 | 3,991.05 | Maintain APY as the current LP seems adequate to meet overall liquidity | Maintain Allocation |

Based on the above criteria, lets us look at the statistics on Theta Mainnet

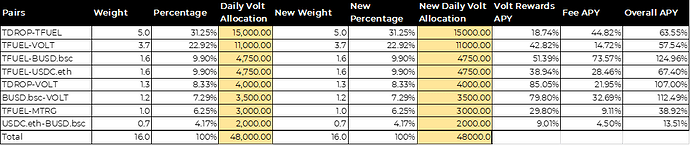

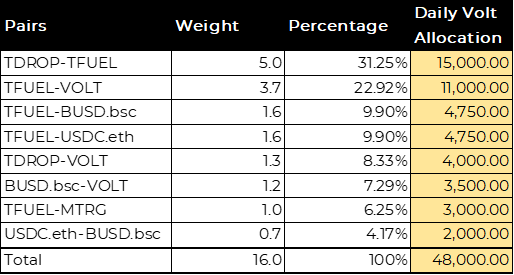

- Current Volt allocation to the Incentivized Pairs

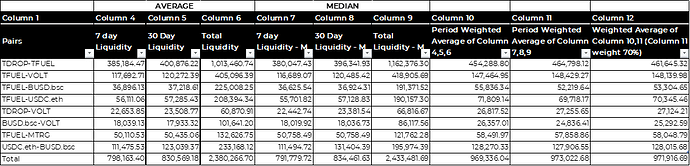

- Period Weighted Liquidity for Incentivized Pairs

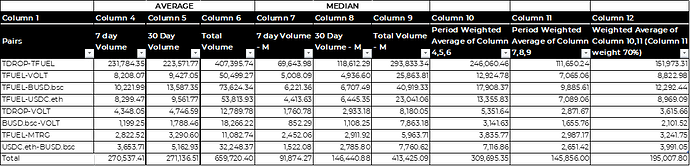

- Period Weighted Transaction Volumes for Incentivized Pairs – Since transaction volumes do depend on market conditions and token specific events, a smoothening effect is applied to add higher weights to immediate past

Column 4,5,6 are average volumes

Columns 7,8,9 are median volumes

Column 12 is the overall average volume of each pair smoothened for periods (7-day, 30-day, Total Vol) and method (average volume and median volume). Pure Average volume would have the bias of outlier days where there is very high transaction volume or very low transaction volume

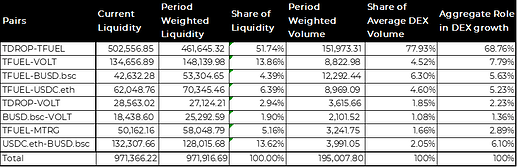

- Evaluation of Pairs based on overall role in DEX Growth (65% weight to transaction volume and 35% weight to TVL)

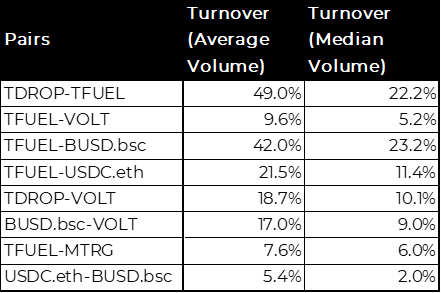

- Turnover (Volume by TVL) for Incentivized Pairs

Based on the above insights, the volt allocation proposed for the 8th cycle on Theta Mainnet are as below;