We are in the process of launching VoltSwap on Theta Mainnet.

Through this proposal, we are trying to;

- Finalize the liquidity pools which should be incentivized on Theta Mainnet

- Determine ‘Volt’ allocation to liquidity pools on both Meter Mainnet and Theta Mainnet.

This proposal intends to override the forum discussion VoltSwap Pair Optimization for next Incentive Pool for below aspects;

- New Pool to be added on Meter Mainnet VOLT-BUSD.bsc to ensure there is more Volt held in liquidity mining with lower impact of impermanent loss than VOLT-MTRG pool

- Reduce daily Volt allocation on ‘Meter Mainnet’ from 103148 Volt as per previous discussion to 95000 Volt to accommodate 45000 Volt allocation to Theta Mainnet.

We present the proposal below;

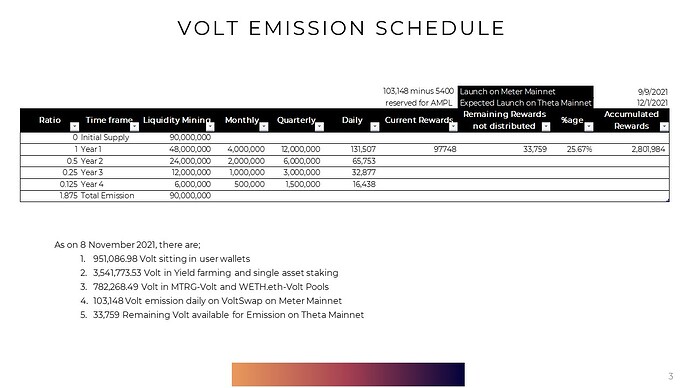

- The Volt Emission schedule over the next 4 years is depicted below. The expected launch date serves the purpose of calculating accumulated rewards (rewards not distributed to users due to effect of rewards multiplier) and is tentative

- Below, we can see the total Volts allocated to the liquidity mining pools and the volts distributed per month/ quarter. For first 90 day cycle, 103148 Volt were allocated for rewards. We propose to reduce them to 95000 Volt per day for second cycle to accommodate Theta Mainnet allocation

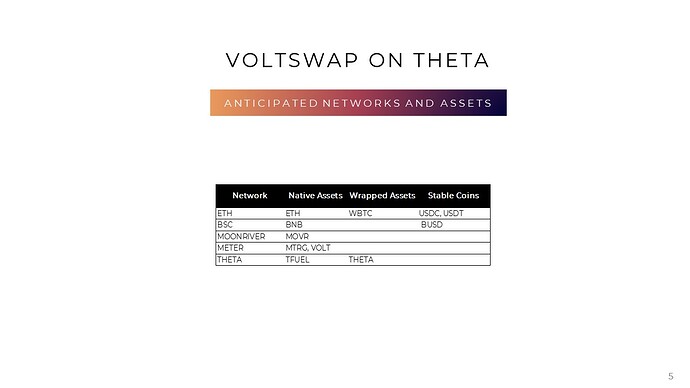

- Potential Assets on VoltSwap on Theta Mainnet

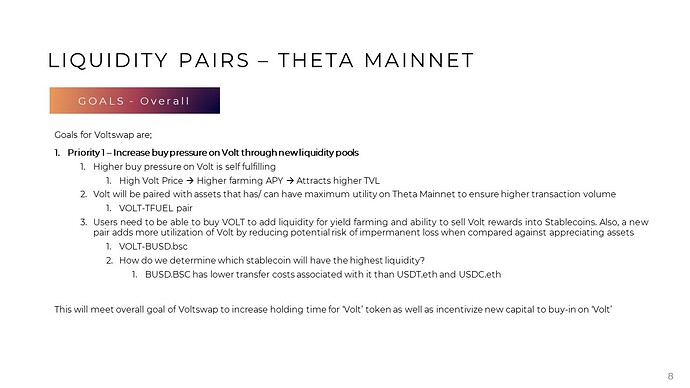

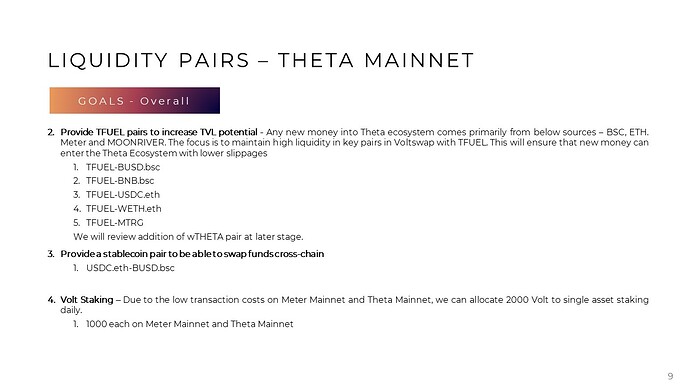

- Goals which help finalize the priority in determining liquidity pairs

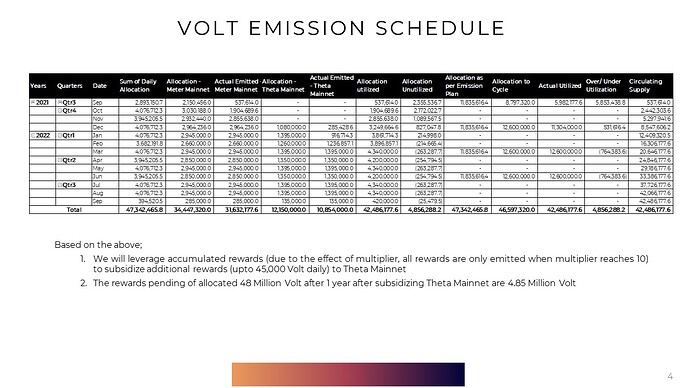

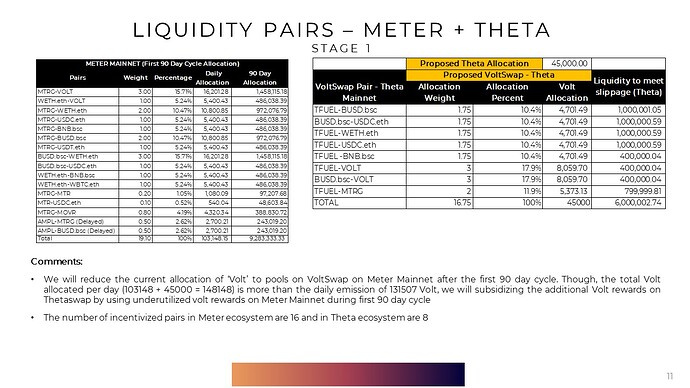

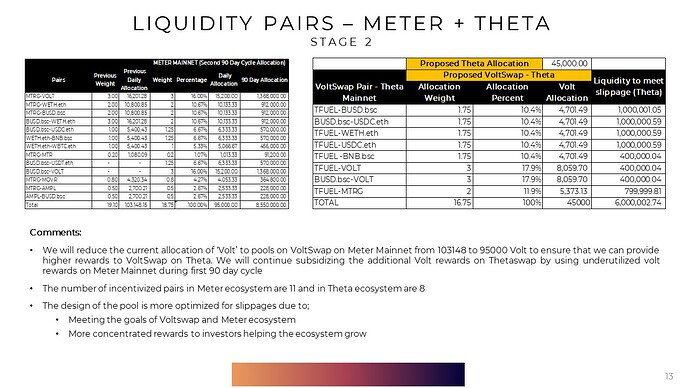

- Due to overlap of VoltSwap launch on Theta Mainnet before end of first 90 day pool cycle on Meter Mainnet, the Volt allocation is represented in 2 stages below.

This Volt allocated proposed overrides forum discussion VoltSwap Pair Optimization for next Incentive Pool due to impact of VoltSwap Launch on Theta Mainnet

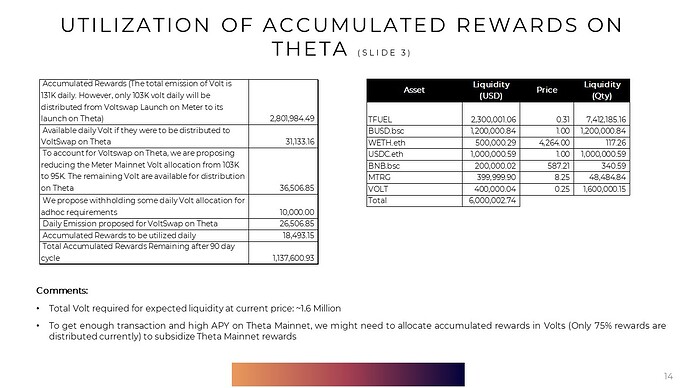

- Since total Volt emission (95000 on Meter + 45000 on Theta) is more than daily emission (131507), we will be using underutilized Volt from the first 90 day pool on Meter Mainnet. We also try to gauge the amount and dollar value of assets required to minimize slippages on VoltSwap

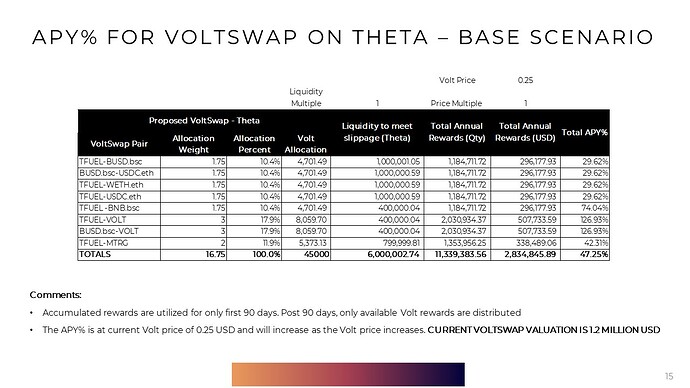

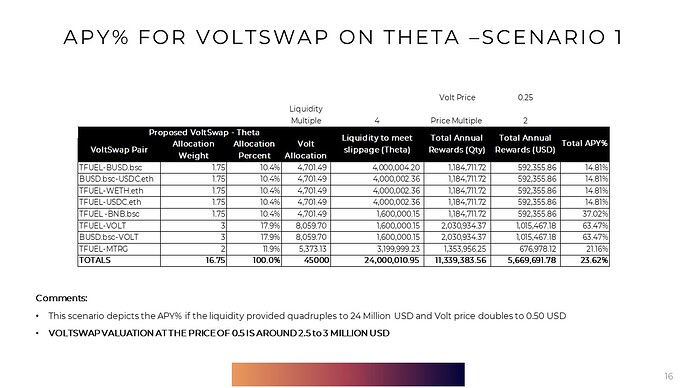

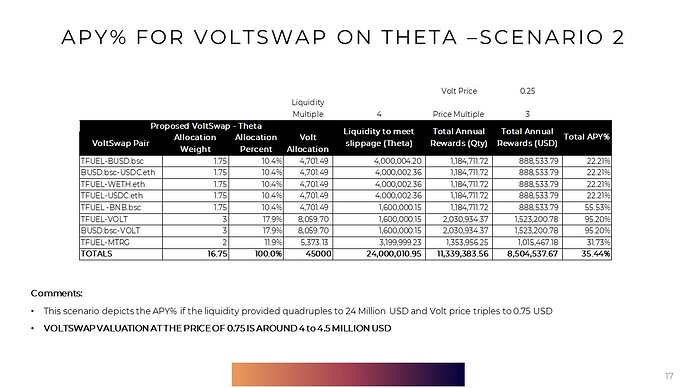

- Below, we try to gauge the APY% if anticipated liquidity is available and APY% under some additional scenarios. We also look at the valuation of VoltSwap in these scenarios.