Hi Community,

We have officially launched Voltswap on Moonbeam with liquidity Mining program kickstarting on 21 January 2022 at 10 am PST.

Through the Moonbeam deployment, we are trying to achieve below objectives;

- Bring Visibility and additional Utility to VOLT token and VOLTSWAP

- Enable liquidity for Meter Passport assets on Moonbeam

- Support Meter Ecosystem partners on Voltswap to gain more traction for VOLT token

With these objectives in mind, let us analyze the current Moonbeam ecosystem. The ecosystem is still in nascent stage but has gained traction.

TL;DR;

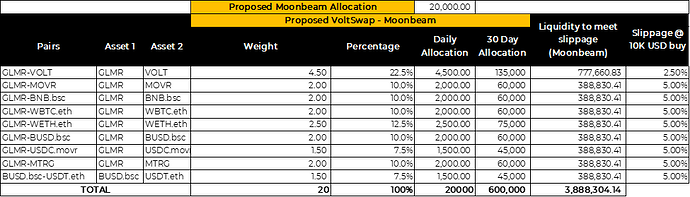

Moonbeam Allocation Proposed;

|Moonbeam Cycle 1 Allocation||||||

|—|—|—|—|—|—|—|

|Pairs|Asset 1|Asset 2|Weight|Percentage|Daily Allocation|30 Day Allocation|

|GLMR-VOLT|GLMR|VOLT|4.5|22.50%| 4,500 | 135,000 |

|GLMR-MOVR|GLMR|MOVR|2|10.00%| 2,000 | 60,000 |

|GLMR-BNB.bsc|GLMR|BNB.bsc|2|10.00%| 2,000 | 60,000 |

|GLMR-WBTC.eth|GLMR|WBTC.eth|2|10.00%| 2,000 | 60,000 |

|GLMR-WETH.eth|GLMR|WETH.eth|2.5|12.50%| 2,500 | 75,000 |

|GLMR-BUSD.bsc|GLMR|BUSD.bsc|2|10.00%| 2,000 | 60,000 |

|GLMR-USDC.movr|GLMR|USDC.movr|1.5|7.50%| 1,500 | 45,000 |

|GLMR-MTRG|GLMR|MTRG|2|10.00%| 2,000 | 60,000 |

|BUSD.bsc-USDT.eth|BUSD.bsc|USDT.eth|1.5|7.50%| 1,500 | 45,000 |

|TOTAL|||20|100.00%| 20,000 | 600,000 |

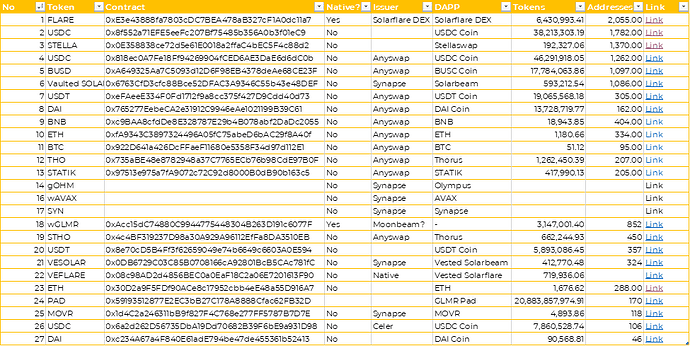

Moonbeam Ecosystem Analysis:

- Assets available on Moonbeam - With a few native assets, majority of assets on Moonbeam are bridged from Ethereum through multiple bridge service providers. The current native assets on Moonbeam are GLMR, STELLA, FLARE

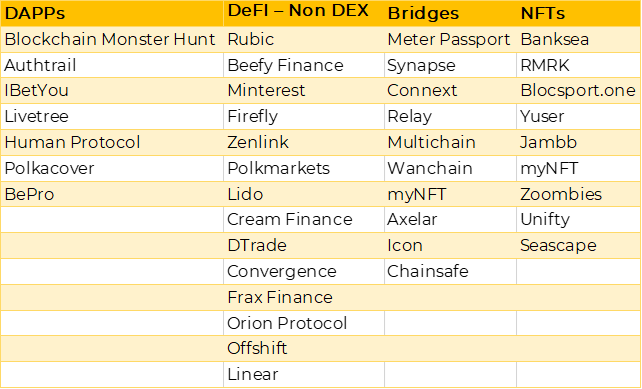

- DAPPs planned for deployment - The DAPPs planned for deployment on Moonbeam network are;

- DEXes on Moonbeam - Users can review the DEXes deployed on Moonbeam at https://dexscreener.com/moonbeam. In addition, below dexes are deployed or planned to be deployed

| No | DEX |

|---|---|

| 1) | Balancer |

| 2) | SushiSwap |

| 3) | Moonlit Finance |

| 4) | IDEX |

| 5) | Injective Protocol |

| 6) | SolarFlare – Deployed |

| 7) | Beamswap – Deployed |

| 8) | Stellaswap – Deployed |

| 9) | Zenlink – Deployed |

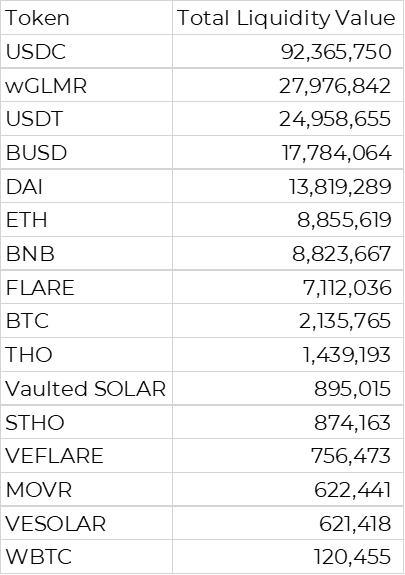

- Assets with most liquidity on Moonbeam

- Top 3 DEXes in terms of TVL

| No | DEX | TVL |

|---|---|---|

| 1) | StellaSwap | $129M |

| 2) | BeamSwap | $73M |

| 3) | SolarFlare | $53M |

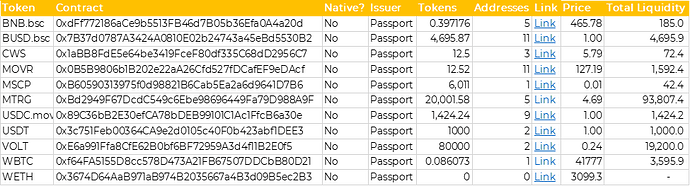

- Meter Passport Assets

- What assets do we want to support on Moonbeam on Voltswap

- GLMR - Yes

- VOLT - Yes

- MTRG - Yes

- BNB - Yes

- Anyswap has around $9 million in liquidity.

- Liquidity should help as SushiSwap might prefer to use BNB on Moonbeam similar to Moonriver

- BUSD - Yes

- Anyswap has around $18 million liquidity

- MOVR - Yes

- Synapse has around $620K liquidity

- CWS - Meter Partner

- MSCP - Meter Partner

- USDC - Yes

- 3+ bridge providers and very high liquidity – Users might try to bridge the asset seeing it has the highest liquidity

- Over $92.3 million liquidity

- USDT - Yes

- Anyswap and Nomad have around $25 million liquidity

- WETH - Yes

- Anyswap and Nomad have around $8.9 million liquidity

- WBTC - Yes

- Anyswap has around $2.2 million liquidity. Same comment as BNB

The overall assets that could be supported are;

- Moonbeam/ Moonriver ecosystem – GLMR, MOVR, USDC

- BSC – BNB

- ETH – WBTC, USDT

- Meter – VOLT, MTRG

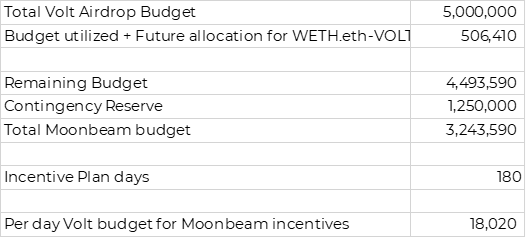

- Availability of VOLT Rewards - As mentioned earlier, the VOLT allocation for the Moonbeam deployment is sourced from the Airdrop budget

- Proposed Pairs and Allocation

- Percent APY and liquidity supported on Moonbeam

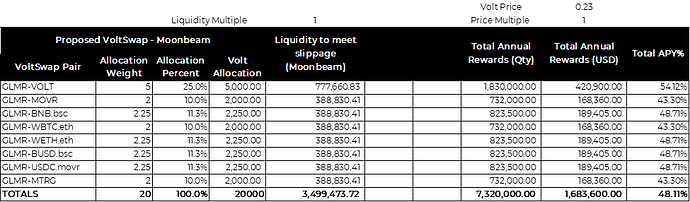

Scenario 1 - At current price and expected liquidity to meet the slippage requirements

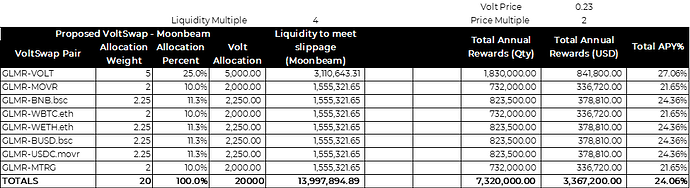

Scenario 2 - Price x2 and Liquidity x4

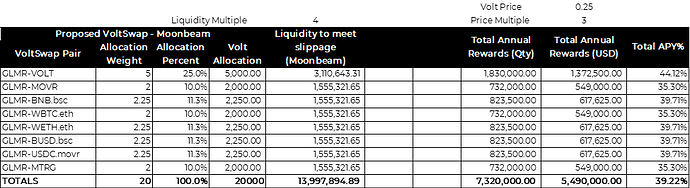

Scenario 3 - Price x3 and Liquidity x4