Foreword: A few days ago, Meter released a compensation plan in response to the Meter Passport exploit on February 5, 2022. The plan mentioned that the affected users would be compensated with MTRG for the overall loss of USD 4.25 million. But as an active member of Meter’s Chinese community, I think that utilizing MTRG to compensate users affected by the exploit is not in the best interests of affected stakeholders and will likely become an obstacle to the development of the Meter Ecosystem. Therefore, I propose that the Meter Foundation should use the foundation’s revenues and future fundraising to repurchase PASS tokens in stages after issuing the Pass bonds.

Purpose of the proposal: In the revised compensation plan, change “compensation with MTRG tokens in 12 months” to “Meter Foundation repurchases PASS tokens in stages”

Reason for proposal:

Why paying with MTRG tokens is a lose-lose scenario

1. MTRG token compensation will adversely impact the development of the project

With over 4.25 million worth of MTRG to be paid over the vesting period of 12 months, there is a potential risk of continuous sell pressure on MTRG over the coming year. This risk is further exacerbated by the fact that half of the compensation will go to the affected users on Moonriver, who would not have the same conviction to stay invested in the Meter ecosystem as the affected users of the Meter ecosystem. The overall result would be lower demand for the token by new investors and institutions over the year due to the potential sell pressure and lack of upward movement in price.

MTRG is also a key component of all major incentives driven by the Meter ecosystem – Hackathon, Developer Grant Program, Bug Bounty. With the compensation paid in MTRG, the efficacy and participation in these incentive programs will have a negative impact.

With an adversarial impact on the growth of the ecosystem, the compensation in MTRG is not beneficial to both the affected users and the Meter community.

The Furucombo Equivalence

A typical example is Furucombo. As a star project invested by Binance, Furucombo released a similar compensation plan after $15 million was stolen in 2021 (Furucombo Mitigation Plan: https://medium.com/furucombo/mitigation-plan-e498a95d335e), few new partners have been introduced since the release of the compensation plan (for details, please refer to this document: Furucombo weekly report collection)The development of the project is greatly affected by this compensation plan. This compensation plan is undoubtedly killing the chicken and getting the egg.

Potential risk of users being compensated not getting the full value

With a compensation plan equivalent to cutting the chicken, the users affected by the exploit actually get lower compensation than initially planned.

With a wider opinion that the current market conditions could continue for some time, a lower buy pressure and resultant sell pressure from the compensation plan would mean the affected users would not get fully compensated for their loss.

Further declines in the market could also lead to a gradual loss of market liquidity due to the impact of impermanent loss over the potential farming rewards. With lower liquidity, the price impacts will be larger.

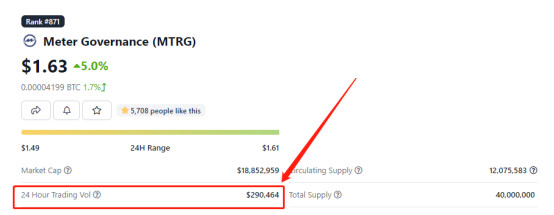

As far as the current depth of MTRG is concerned, the 24-hour trading volume is only US$290,000, while the gate exchange, which has the largest trading depth, has a depth of only tens of thousands of US dollars.

(Data source: coingecko)

(Data source: CoinGecko)

And 4.25 million USD, divided into twelve months, will generate 354,000 USD worth of sell pressure every month. This magnitude of sell pressure without resulting buy pressure can impact the price of MTRG considerably.

As the price drops, so does the conviction of remaining holders.

Why it would be better for the Meter Foundation to buy back PASS tokens

Reliability and Accountability of Meter Team

In the six months since I became a volunteer of Meter and started to take charge of the Meter Chinese community, I saw the efforts and persistence of the Meter project team. With a strong team led by Mr. Zhu, the CEO of Meter, and the consistent developments across several projects in the Meter ecosystem like Voltswap, Meter passport, Sumer, etc.

I have seen that in the last few months, Voltswap has been listed on the Meter mainnet, Theta mainnet, and Moonbeam mainnet successively within a few months of its release, and Meter Passport has secured partnerships across dozens of impactful projects. The ecosystem has also grown significantly over the last few months with numerous defi protocols and integrations (Ampleforth, Sumer, Defillama, 0xtracker, Gnosis Safe, Voltswap, Golucky.io, BEPRO, Chee Finance, TreasureBlox, BusinessBuilders)

NFT Market: ToFUNFT, Businessbuilders, Boring Mantis,

Support Networks on Passport: Energy Web, POLIS, Meter parallel chain Verse, multi-chain smart contract platform Parastat, Polygon, Moonriver, Moonbeam, Avalanche. Future partnerships include projects such as Acala, Helmet, and equalizer. These are just some of the collaborators I’ve listed.

Meter’s ecology is taking shape! Why should we not choose to trust Meter?

Successful precedent: Bitfinex successfully pays off debt after 120,000 bitcoins are stolen

In 2016, the Bitfinex exchange was shocked by a security breach, which resulted in the theft of 119,756 BTC on the platform, which is equivalent to nearly 36% of the assets of platform users. Then Bitfinex resolutely chose to issue bonds and hold irregular repurchases. At first, many people questioned that the token compensation was just to introduce delay and that Bitfinex had no intention of compensation. However, with the normal operation of Bitfinex, the exchange grew larger and was able to redeem the bonds successfully far earlier than anticipated.

For the income source of Meter Foundation, Meter has various income sources, including the future financing of the foundation, foundation investment, project cooperation income, and other various income sources.

Finally, I would like to say that in history, any success has unmistakably gone through setbacks, and those who can endure the setbacks will taste success. Between “loss of 70-80%” and “choose a reliable team and stand together through thick and thin”, I think the latter is obviously the correct answer especially when Meter’s ecology is finally taking shape. As long as it grows, compensation for the affected users should not be a problem.

Wish the Meter community a fortune!