Community,

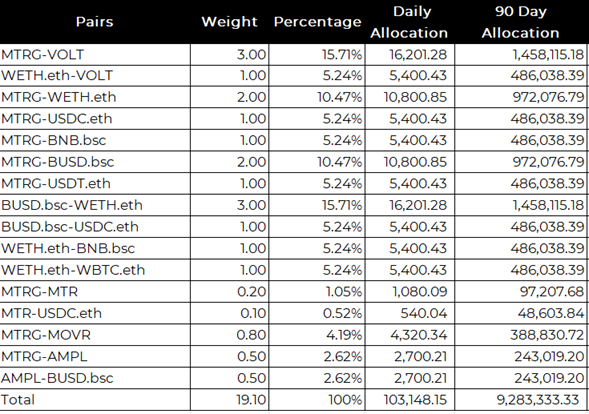

Voltswap was introduced on Meter Mainnet on 9th September 2021. The initial design required a setup of 90-day incentive cycle for yield farming with Volt allocated to the incentivized pools for 90 days. The initial allocation was as below;

The Rewards Multiplier increased from 1x to 10x over 70 days gradually and linearly to incentivize long term yield farming.

However, there were certain aspects of the design which do not seamlessly align with Voltswap ecosystem growth.

Yield farming incentives still leans more towards behavioral science than an exact science. This meant that it is difficult for the team to determine which liquidity pools would get traction in terms of Total Value Locked and Transaction Volume.

With incentive allocation locked for 90 days, we were not able to reallocate the incentives to the pools depending on what assets gained traction on Voltswap. For e.g.:

-

WBTC.eth-WETH.eth pool had over 1 million USD TVL but 7d average transaction volume of only 43K when forum discussion on pool optimization was identified. The pool continued receiving 5400 Volt per day until 8 Dec 2021

-

Similarly MTRG-BNB.bsc and MTRG-USDT.eth too had low liquidity of around 200K and transaction volumes of 30-40K USD but kept received 5400 Volt per day until 8 Dec 2021

-

In contrast, MTRG-BUSD.bsc has 500K liquidity and 300-400K 7D average transaction volume. With additional incentives, the pool could have attracted higher liquidity

From above discussion, let us reiterate two critical parameters in yield farming incentives on Voltswap;

- Incentive Period: It is the period for which the liquidity pools are assigned with the prescribed Volt emission. For initial launch on Meter Mainnet, the incentive period was 90 days. The yield farm contracts were allocated VOLT emission to meet the daily emission of VOLT for 90 days

- Rewards Multiplier: It is the design to incentivize long term behavior in yield farming. Users providing Liquidity over longer period see their rewards multiplier increase from 1x to 10x over 70 days. The rewards multiplier continues to remain 10x until the user unstakes their LP tokens from the yield farming program. See more detailed explanation in Voltswap docs here - Link

Proposed Change to the next incentive cycles;

Taking inputs from thought process above, we propose below changes

- Incentive period - We propose to reduce the incentive period from 90 days to 30 days. This means that the yield farming contracts will now be allocated VOLT emission to meet daily emission of VOLT for 30 days.

- Rewards Multiplier - We propose no change to the rewards multiplier design

Benefits of the Proposed Change;

Community will be able to better align the incentives to liquidity pools that ensure growth of the ecosystem.

This will ensure that liquidity pool incentives are not halted immediately with liquidity provides getting caught off-guard.

General outline for realignment of incentives can be as below;

| Liquidity Pool | Ongoing Incentives | New Incentives |

|---|---|---|

| Low liquidity, Low transaction Volume | ‘X’ volt emission | 0.5x to 0.67x volt emission - Reduce incentives gradually |

| Low liquidity, high transaction Volume | ‘X’ volt emission | 1.2x to1.3x volt emission – Increase volt emission to attract higher liquidity |

| High liquidity, low transaction volume | ‘X’ volt emission | 0.8x to 0.9x volt emission – gradual reduction to maintain TVL |

| High liquidity, high transaction volume | ‘X’ volt emission | 1.1x to 1.2x volt emission depending on reduction of emission from other pools |

| New Critical Pool Introduction | ‘0‘ Volt emission | Add weight to the pool to move incentives from other pools to the critical pool |

Why 30 days?

It is not an exact science. However, the duration is long enough to not bring significantly more development (refilling of pools with volt) or administrative (governance proposal for new incentives) overheads while achieving the results it intends.

Impact on Liquidity Providers;

- Shuffling of Liquidity

- LPs will have to be more vigilant to ensure that they shuffle liquidity to pools with maximum yield based on new incentives

- Reduced incentive cliffs

- LPs will now be protected against sudden cliffs in rewards incentives (5% to 0%). This process will be gradually incorporated to allow LPs to shuffle their liquidity and regain multiplier quickly