Hello Meterians,

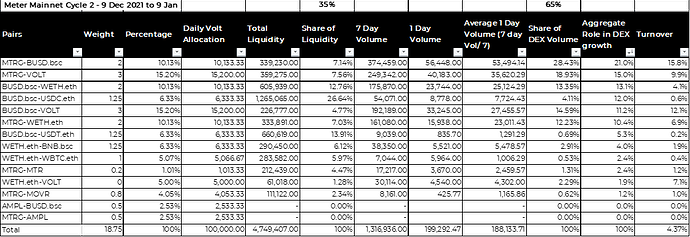

The Second Incentive cycle on Meter Mainnet started on December 9, 2021. It will end on January 9, 2022.

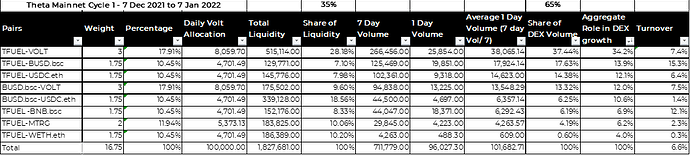

The first Incentive cycle on Theta Mainnet started on December 7, 2021. It will end on January 7, 2022.

We are taking this opportunity to gauge the progress of the incentive program on both Meter Mainnet and Theta Mainnet.

Below analysis provides a general guideline for Volt Incentive Allocation which will be finetuned through community inputs.

The Background:

The ongoing cycles on both the networks differ from the first Incentive cycle on Meter Mainnet in one critical aspect,

| Parameter | Network | First Cycle | Second Cycle |

|---|---|---|---|

| Incentive Period | Meter | 90 days | 30 days |

| Rewards Multiplier | Meter | 1x to 10x in 70 days | 1x to 10x in 70 days |

Let us reiterate what incentive period and rewards multiplier are for the sake of clarity;

Incentive Period: It is the period for which the liquidity pools are assigned with the prescribed Volt emission. For the initial launch on Meter Mainnet, the incentive period was 90 days. The yield farm contracts were allocated VOLT emission to meet the daily emission of VOLT for 90 days

Rewards Multiplier: It is the design to incentivize long-term behavior in yield farming. Users providing Liquidity over a longer period see their rewards multiplier increase from 1x to 10x over 70 days. The rewards multiplier continues to remain 10x until the user unstakes their LP tokens from the yield farming program.

The primary rationale for the reduction in the incentive period was to be able to align the incentives according to the performance of the incentivized pairs.

Evaluation of Incentivized Liquidity Pairs:

We could define a few of the critical parameters that will help us evaluate the performance of the liquidity pairs on Voltswap;

- Transaction Volume

- This is by far the most important parameter for evaluation since the goal of the product is to generate free cash flows from the operations and be self-sustainable

- While evaluating incentivized pairs for transaction volume, a few critical questions have to be addressed in tandem;

- How many transactions drove the transaction volume

- What was the average value of each transaction

- Addressing the above questions helps us estimate whether the pool needs deeper liquidity than what it has currently. A high number of low-value transactions might mean the pool has high capital efficiency but need not have deeper liquidity

- Total Value Locked (TVL)

- This is a critical parameter to gauge the adoption of the DEX. Higher TVL is typically correlated with higher adoption and enables bigger buys on the DEX without too high a price impact

- Turnover of the pair

- It can be defined as the ratio of Volume by TVL

- Higher volume for a specific TVL means that the pair has a higher utilization of assets and the LPs are generating higher revenues due to the turnover.

- Number of Txs and average transaction value

- The average transaction value helps us estimate whether the liquidity available in the pool is enough to ensure the users have lower slippages

- While evaluating the average transaction value, we also have to be cognizant of the arbitrage transactions which will tend to reduce the value

Evaluation Parameters:

- The overall role of a pair is a factor of both the TVL it adds to the Voltswap as well as the transaction volume of the pair. However, the intent of TVL is to primarily aid transactions and lower slippages.

- While evaluating the pairs, we will try to weigh transaction volume at 65% and TVL at 35% to determine an overall role of a pair in the growth of the ecosystem

- We will also try to look at the turnover (1-day Volume by TVL) to determine the capital efficiency of the pairs

- Lastly, we will look at the total transactions since the start of the pool and the average transaction value. This data is currently available only for Meter Mainnet.

Based on the above parameter, lets us look at the statistics on both Meter Mainnet and Theta Mainnet

TVL, Transaction Volume and Turnover:

Meter Mainnet

Insights:

- The top 5 pairs - having the most volume, are also allocated the most volt (> 10%)

- As expected, MTRG-BUSD.bsc, MTRG-VOLT, and BUSD.bsc-VOLT have the highest capital efficiency over a 7-day period

- The stable coin pairs BUSD.bsc-USDC.eth and BUSD.bsc-USDT.eth have both high liquidity but very low transaction volume leading to very low turnovers. One primary reason could be the lack of USDC.eth and USDT.eth transfers from eth due to high bridge costs. We could evaluate reducing the volt allocation to both the pools

- WETH.eth-WBTC.eth and MTRG-MOVR both seem to have higher allocation in comparison to the TVL and transaction volume contribution

- WETH.eth-VOLT has got the allocation of 5000 Volt through a governance proposal to aid the users to recoup the impermanent loss faced during the first cycle

Overall the transaction volume seems well in line with the anticipation, confirming that Volt allocation to the pools is appropriate at current Volt Prices.

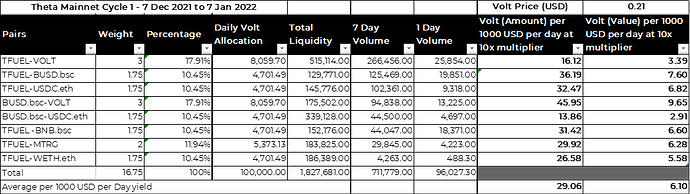

Theta Mainnet

Insights:

- The TFUEL-VOLT has very high traction and seems to drive most liquidity and transaction volume. Additional allocation can be reviewed to ensure deeper liquidity. This will help in reducing price impact on Volt sell pressures as well.

- If some of the other pairs are not able to get traction in line with their Volt allocation (Aggregate role % << Volt allocation percentage), we can evaluate diversion of Volt rewards to TFUEL-VOLT pool

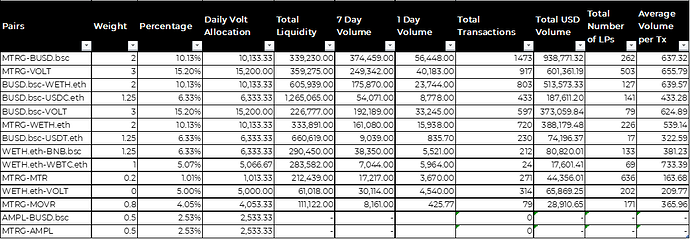

Average Transaction Value on Meter Mainnet

Insights:

- WETH.eth-WBTC.eth and MTRG-MOVR stand out in terms of the number of transactions. The transactions primarily seem to be arbitrages.

- BUSD.bcs-USDT.eth has very low transaction volume as well as value

*the last column incorrectly say ‘Volume’ instead of ‘Value’

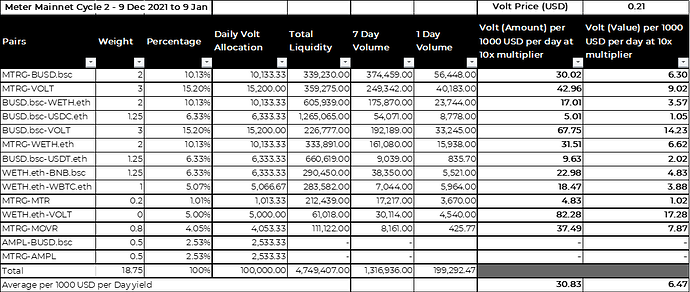

Volt rewards earned per 1000 USD of liquidity

In this analysis, we provide more clarity to users on the pools where they can allocate additional capital to get more Volt rewards per $1000.

The reward value is at Volt price of 0.21 USD and 10X multiplier.

At current price, the valuation of Voltswap is around $1.7 million.